NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

After a record-breaking year for IPOs in 2021, so far 2022 has been off to a slower start. Instacart is one of the most highly anticipated IPOs for investors this year, but in March, the grocery delivery startup cut its valuation by almost 40 percent, citing market conditions. Alternative data from Bloomberg Second Measure shows that while Instacart sales are still higher compared to pre-pandemic levels, its year-over-year sales growth and average sales per customer are declining. However, Instacart is continuing to see sales growth in some metro areas like Dallas, Philadelphia, and New York.

Instacart sales remain elevated, but year-over-year growth has slowed

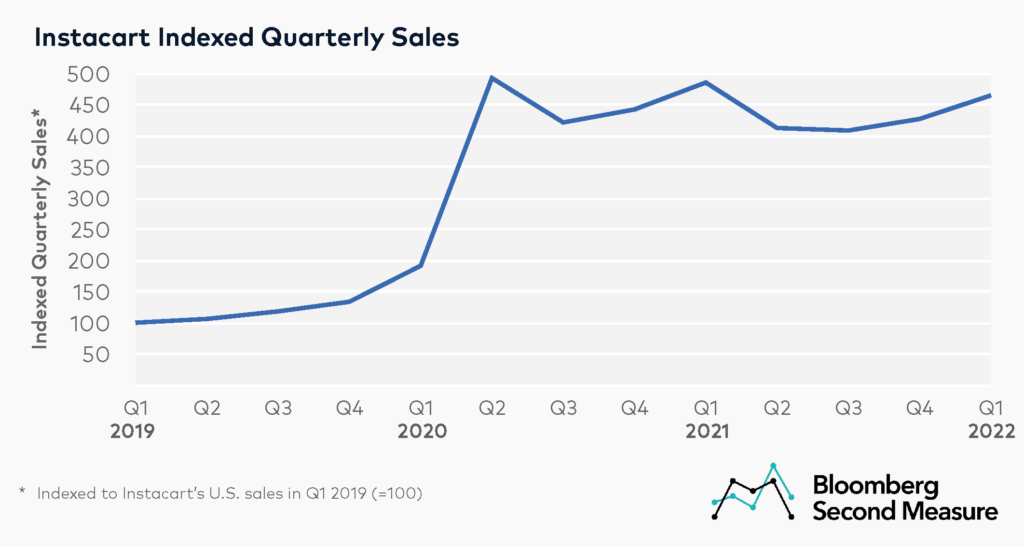

Grocery delivery companies such as Instacart experienced heightened demand during the pandemic. Our data shows that between the first and second quarters of 2020, Instacart’s sales grew 157 percent and have remained elevated. In 2020, the average quarterly year-over-year sales growth was 236 percent.

The company has not been able to sustain the strong year-over-year growth it experienced early in the pandemic. For every quarter since Q2 2021, Instacart’s sales have been slightly lower compared to the same period the year before. In the first quarter of 2022, Instacart’s sales were 4 percent lower than in the first quarter of 2021.

An increasingly crowded grocery delivery market may be another contributing factor to Instacart’s declining sales growth. In addition to companies like Walmart and Amazon offering their own grocery delivery services, Instacart has also faced grocery competition in recent years from meal delivery services like DoorDash and Uber Eats as well as ultra-fast delivery startups like Gopuff.

Instacart’s average sales per customer have declined from its pandemic peak, but still exceed pre-pandemic levels

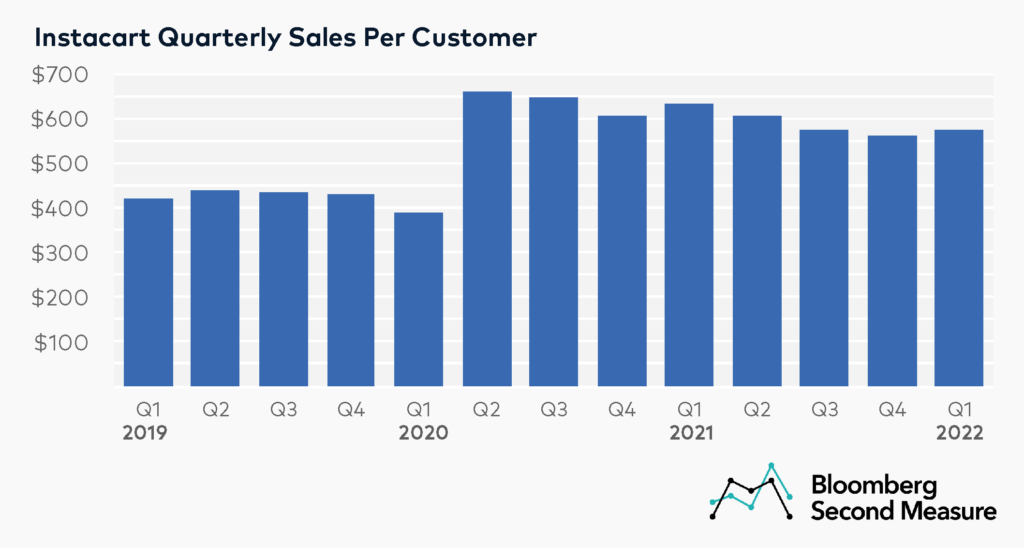

Another potential factor in Instacart’s declining sales growth is that customers are spending less at the grocery delivery company than they did at the beginning of the pandemic. Average quarterly sales per customer at Instacart grew 69 percent between the first and second quarters of 2020, but have gradually decreased since then. In Q1 2022, Instacart customers spent $576 on average, a 9 percent decrease from the same quarter in 2021. Rising food costs and recently implemented fuel surcharges for Instacart orders may affect average sales per customer in future quarters.

Even though the average amount each customer spends at Instacart has declined over the past few years, customer counts have been on the rise. In Q1 2022, Instacart’s customer counts were 5 percent higher than in Q1 2021 and 65 percent higher than the first quarter of 2020.

Instacart sales are still growing year-over-year in some metro areas

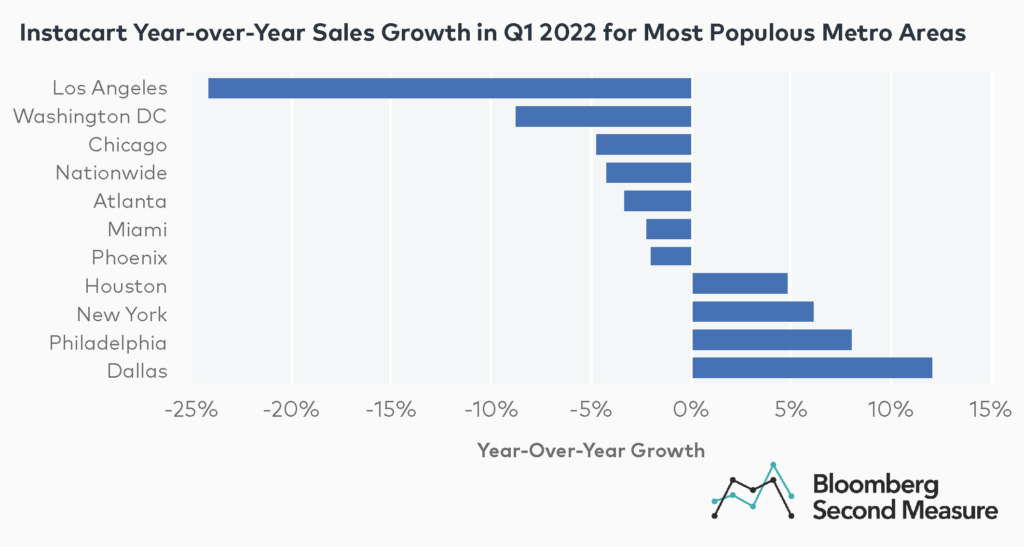

At a more local level, Instacart is continuing to see sales growth in select metro areas. Among the top ten metro areas by population, four metros had a positive year-over-year growth rate in quarterly Instacart sales: Dallas, Philadelphia, New York, and Houston.

In the first quarter of 2022, Instacart experienced a 12 percent increase year-over-year in its Dallas sales, exceeding the company’s national growth rate of -4 percent. Instacart sales in the Philadelphia metro area grew 8 percent year-over-year, while sales in New York and Houston grew 6 percent and 5 percent, respectively. Instacart’s year-over-year sales growth in Chicago was on par with the national average during this time frame. On the other hand, the Washington, DC and Los Angeles metro areas fared the worst, experiencing year-over-year sales declines of 9 percent and 24 percent, respectively.

Is an Instacart IPO still on the horizon?

In light of Instacart’s reduced valuation, investors may be wondering if an Instacart IPO should be expected this year. According to Instacart CEO Fidji Simo, the new valuation does not affect their plans for an IPO, but the company is in “no rush” to go public. Instacart is reportedly exploring new revenue streams through its self-service ad platform and its shoppable recipe partnerships with platforms like TikTok and Tasty. Last month, Instacart also launched the Instacart Platform, a suite of services for retailers that includes in-store smart carts, analytics tools, and nano-fulfillment centers that enable 15-minute delivery.

*Note: Bloomberg Second Measure regularly refreshes its panel and methods in order to provide the highest quality data that is broadly representative of U.S. consumers. As a result, we may restate historical data, including our blog content.